Estate Planning Council of CANADA

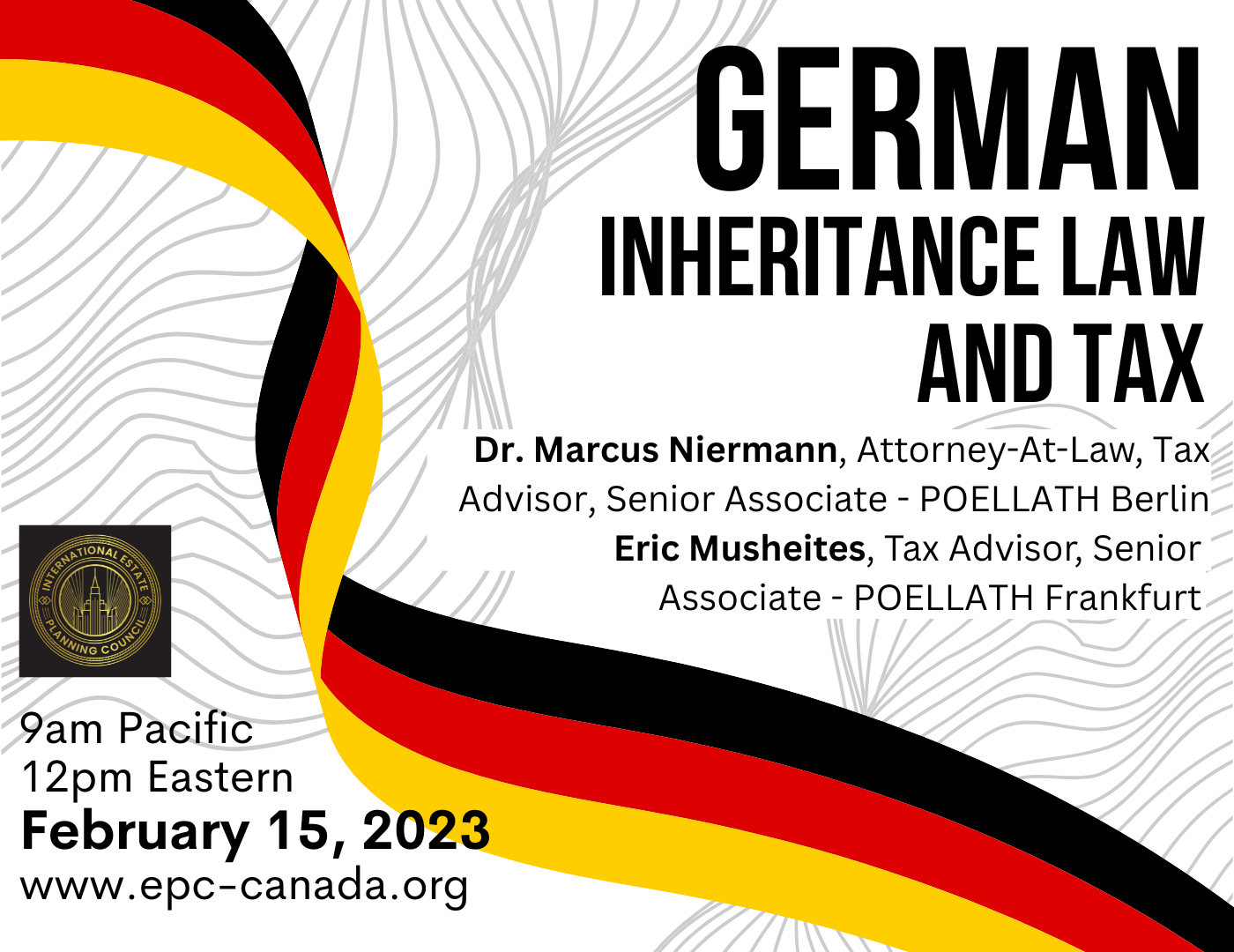

German Inheritance Law and Tax - 02/23

Description

Included: Video Recording / Slides / (1.5 hours)

Do you have clients with relatives, property, inheritances or business in Germany? Learn about inheritance tax and planning strategies for residents and non residents.

Part 1: German Inheritance Law

Applicability of German inheritance law: Significance of last habitual residence and choice of law

Splitting the estate in the case of foreign real estate

Recognition of foreign wills/inheritance contracts

German law on compulsory portions

The Ordre Republic reservation in the absence of a right to a compulsory portion

Part 2: German Inheritance Tax

Inheritance tax liability (Unlimited inheritance tax liability for German residents, extended unlimited inheritance tax liability, limited inheritance tax liability on domestic assets)

Inheritance tax allowances and tax rates

Exemption amounts for business assets

Double taxation in international inheritance cases, as only few DTAs exist

Tax treatment of foreign trusts and foundations

Dr. Marcus Niermann, Attorney-at-Law, Tax Advisor, Senior Associate / Berlin

Erik Muscheites, Tax Advisor, Senior Associate / Frankfurt

POELLATH - P+P Pöllath + Partners - www.pplaw.com